November 1st marked the start of “open-enrollment”, when individuals and employers alike look to renew their health insurance benefit plans for the upcoming year. While weighing serious issues like pre-existing medical conditions to an impending surgery or even a root canal, choosing the right plan with the best coverage can be confusing, daunting and subsequently very stressful!

In her recent article, “Choosing a Health Insurance Plan Is Not ‘Shopping’” New York Times writer, Helaine Olen, eloquently described open-enrollment as “the arduous annual ritual of reviewing the complex and all but impossible to decipher health insurance options.” She adds that in a recent United Healthcare survey they found “more than a quarter of respondents would rather lose their credit card, smartphone or luggage, not to mention suffer a flat tire, than review their health insurance options during open-enrollment periods.”

Perhaps one path to clarity is to simplify the ‘why’ and reflect back in history when medical and health care programs were just being established.

‘Prepaid medical care programs for employees and their dependents’ began in the U.S. during the late 19th century but really ‘were established’ in the early 20th century to protect employees and their dependents in many industries such as ‘mining, lumbering and the railroads’. Common sense speaks to the obvious need for medical services while conducting work in these industries. (Source)

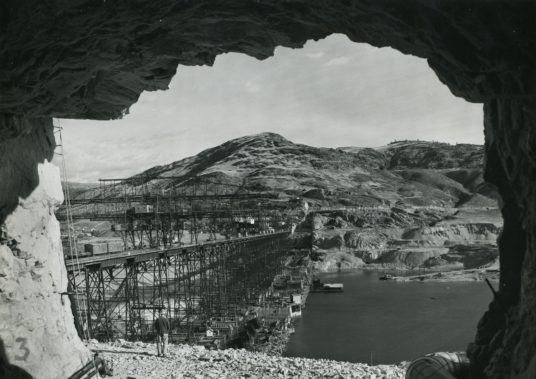

Prompted by the depression, the U.S. government initiated large public works projects to ‘get men back to work’ and in 1938 construction of “Public Works Project No. 9” marked the beginning not only of the Washington State’s Grand Coulee Dam but also “The Kaiser Foundation Health Plan.” The health plan was created to protect Kaiser’s construction workers and their dependents during the building of the dam. (Source)

Dangerous and demanding construction work, reportedly over 12,000 people worked on the Grand Coulee Dam. “Seventy-two died on the job, mostly from falling or from having something fall on them,” author Cassandra Tate states in her 2005 essay, “The Grand Coulee Dam.” Tate adds that “contrary to myth, none were buried in the concrete.” Kaiser later sponsored plans for their shipyard workers (and families) and eventually extended coverage plans to the ‘community at large’ in 1945. (Source)

Obviously imperative back in 1938, healthcare still remains ‘fundamental to our lives’ in 2018.

However, unlike then, nowadays there are many sponsored plans to choose from. An experienced health insurance broker can help navigate through the options and help choose the best plan to match both the needs of the employees and their employers.

To start a conversation about your group benefits, please call us at (360) 419-9999.

Healthcare is complicated. We are here to help.

Group Benefits Northwest is a benefits and health insurance broker for small to midsized companies. Family owned and operated, they have proudly served Seattle and surrounding area businesses, since 1982. Group Benefits Northwest leverages over 30 years of business, management and group benefits experience to provide the very best healthcare plans available to meet employer and employee needs.