What is an HSA?

“HSAs or Health Savings Accounts, are probably one of the less utilized solutions in the marketplace today even though they’ve been in effect for 10 years, ” says Steve Brown, Owner and Principle Broker at Group Benefits Northwest. “An HSA is a bank account that you put money into, pre-tax, for healthcare expenses. The IRS limits how much you can contribute — for 2019, it’s $3,500 per person and $7,000 per family.” (source)

“HSAs or Health Savings Accounts, are probably one of the less utilized solutions in the marketplace today even though they’ve been in effect for 10 years, ” says Steve Brown, Owner and Principle Broker at Group Benefits Northwest. “An HSA is a bank account that you put money into, pre-tax, for healthcare expenses. The IRS limits how much you can contribute — for 2019, it’s $3,500 per person and $7,000 per family.” (source)

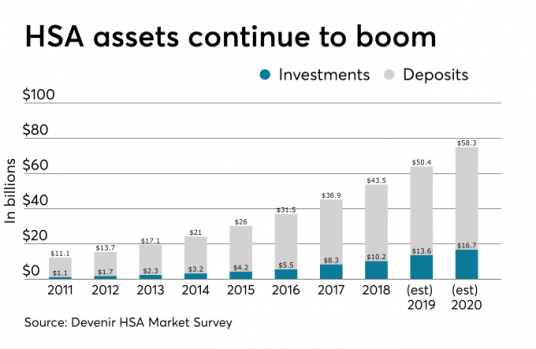

However, this is changing and reportedly the HSA market is ‘surging on all fronts.’ According to a recent Devenir report, “the number of [HSA] accounts grew 13% over the past year.” It appears employers and their employees are recognizing the cost saving advantages still offered by HSAs. Indeed from 2017 to 2018 the average employer contribution increased 39%.

HSAs provide great benefits, tax benefits and some really, really good healthcare plan options.

If you’re interested in learning more about what benefits a HSA might offer you, call us in Mount Vernon at (360) 419-9999 or in Seattle, WA at (206) 910-4630.